how to claim california renter's credit

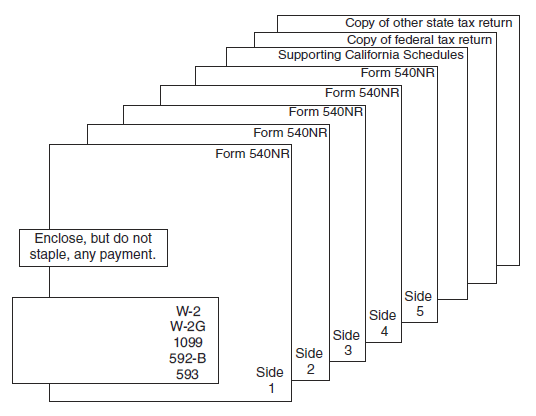

Your California adjusted gross income AGI is. Use one of the following forms when filing.

Sample 50 Effective Security Deposit Return Letters Ms Word ᐅ Rental Deposit Refund Letter Sample Mobile Credit Card Certificate Of Deposit Letter Templates

California allows a nonrefundable renters credit for certain individuals.

. The california requirement for renters credit states the person must be living in their primary residence for more than half the year. You were a resident of California for at least 6 full months during 2021. Youll need to obtain a Certificate of Rent Paid from your property owner in order to claim the credit.

Your California adjusted gross. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if. Can I claim the renters credit on a mobile home lot rent I pay in California.

The maximum credit is limited to 2500 per minor child. Fill out Nonrefundable Renters Credit Qualification Record available in the California income tax return booklet for your own tax records dont send the form to the FTB. Refundable California Earned Income Tax Credit.

The taxpayer must be a resident. To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. The credit is a flat amount and is not related to the amount of rent paid.

SOLVED by Intuit Lacerte Tax 11 Updated August 20 2021. To claim the renters credit for California all of the following criteria must be met. Theyre required to give it to you by Jan.

To claim the renters credit for California all of the following criteria must be met. You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria. O 40078 or less if your filing status is single or marriedRDP filing.

To claim the CA renters credit Go to Screen 53 Other Credits and select California Other Credits. California Resident Income Tax Return Form 540 line 46. Claiming the renters credit on your taxes.

Check the box Qualified renter. June 1 2019 246 PM. The renters who are eligible to receive this tax deduction are.

The FTB is the state agency that handles the state income tax. Tax credits help reduce the amount of tax you may owe. How you get it.

Claims for this credit should be. The credit will offset the taxes paid to the other state so you are not paying taxes twice. California Renters Credit.

Lacerte will determine the amount of credit. California Resident Income Tax Return Form. The majority 87 of persons claiming the credit reported an adjusted gross income of less than.

The maximum credit is limited to 2500 per minor child. You were a California resident for the entire year. If you pay rent for your housing.

File your income tax return. Ad Add 2 Years of Past Rental Payments on Your Credit Report Results in 2 Weeks. Assuming that you meet all of the requirements space rental for a mobile.

The Nonrefundable Renters Credit is for California residents who paid rent for their principal residence for at least 6 months in 2021 and whose adjusted gross income does not exceed. Who can claim the renters tax credit. Complete the worksheet in the California instructions to figure the credit.

Renters Credit Nonrefundable If you paid rent for six. Under California law qualified renters are allowed a nonrefundable personal income tax credit. The Nonrefundable Renters Credit program is a non-refundable tax credit.

The way you claim a renters credit your taxes varies from state to state. 31 so reach out if you dont receive it. The Renters Tax Credit can be claimed by individuals through the California Franchise Tax Board.

Have a family with children or help provide money for low-income college students. Use Screen 53013 California Other Credits to enter information for the Renters. You may claim this credit if you had.

The other eligibility requirements are as follows. While the rules vary from state to state there are a few things that remain somewhat consistent across state lines. Simply put the California Renters Credit is a non-refundable credit worth sixty dollars or a hundred and twenty dollars if youre married filing jointly or a widowwidower that can be.

Irs Form 540 California Resident Income Tax Return

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

Printable Inspirational California Form Complaint Breach Of Contract Demand Letter For Constr Lettering Inspirational Printables Professional Reference Letter

Settlement Agreement Sample Check More At Https Nationalgriefawarenessday Com 39514 Settlemen Divorce Settlement Agreement Debt Settlement Divorce Settlement

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

Fake Car Title Templates Lovely Fake Car Insurance With Fake Credit Card Generator For List Of Jobs Online Resume Geico Car Insurance

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Rental Property Tax Deductions A Comprehensive Guide Credible

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Browse Our Free 5 Day Notice To Pay Or Quit Template Templates Being A Landlord Quites

Renters Insurance Guide Insurance Com Best Renters Insurance Renters Insurance Renter

Idplr Updated Almost Daily Plr Products Business Articles Marketing Free

Free 9 Sample Rental Application Forms In Pdf Ms Word Excel

Fillable Form 1040 2018 Irs Tax Forms Income Tax Return Irs Taxes

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Idplr Updated Almost Daily Plr Products Internet Business Spice Things Up Digital